Executive Summary

Stablecoins are transitioning from experimental instruments to foundational financial infrastructure. What was once viewed as a crypto-adjacent innovation is now increasingly understood as a practical settlement and treasury primitive for global businesses.

Based on global survey data across financial institutions and enterprises, stablecoins are no longer evaluated on ideological grounds, but on speed, cost efficiency, settlement certainty, and regulatory viability. Adoption momentum is strongest where traditional financial infrastructure fails to meet modern cross-border requirements—particularly in payments, treasury operations, and liquidity management.

The next phase of adoption will not be driven by speculation, but by execution.

1. Stablecoins Have Crossed the "Utility Threshold"

Across regions and sectors, stablecoins are increasingly viewed as a gateway to broader tokenized financial workflows, rather than a standalone asset class.

Global finance leaders identify stablecoins as:

- A stable medium of exchange for cross-border settlement

- A programmable representation of fiat value

- An entry point into tokenized payment and treasury systems

Survey results indicate that over 80% of financial institutions and enterprises are open to using stablecoins, with more than one-third already active in production environments.

This shift marks a clear transition: from "Should we use stablecoins?" to "Where do they materially outperform existing rails?"

2. Payments Lead Adoption — For Structural Reasons

When asked where stablecoins deliver the most value, respondents consistently ranked:

- Cross-border payments

- Alternatives to traditional banking rails

- Trade and settlement workflows

This is not accidental. Cross-border payments expose the structural limits of legacy infrastructure:

- Long settlement windows

- Multiple intermediaries

- Opaque FX pricing

- Capital locked in pre-funded accounts

Stablecoins compress these inefficiencies by enabling near-instant settlement, 24/7 availability, and simplified FX execution, reducing both operational and financial friction.

3. Speed, Cost, and Market Access Drive Enterprise Demand

For active users, three benefits consistently dominate:

Settlement Speed

Real-time or near-real-time settlement reduces exposure to FX volatility and counterparty risk.

Cost Reduction

Enterprises report materially lower transaction costs compared to traditional correspondent banking, particularly in high-friction corridors.

Market Expansion

Stablecoins enable access to regions with limited banking infrastructure, supporting supplier payments, payroll, and treasury flows without local account complexity.

Notably, these benefits are operational, not speculative.

4. There Is No "One Digital Currency" Strategy

Survey data confirms that no single digital currency type satisfies all business needs. Instead, different instruments excel at different functions:

- Stablecoins lead in settlement speed and cross-border cost reduction

- Tokenized assets expand treasury and liquidity management

- Traditional fiat remains dominant for end-user familiarity

Stablecoins consistently rank highest for:

- Accelerating cross-border settlement

- Simplifying FX conversion

- Reducing international transaction costs

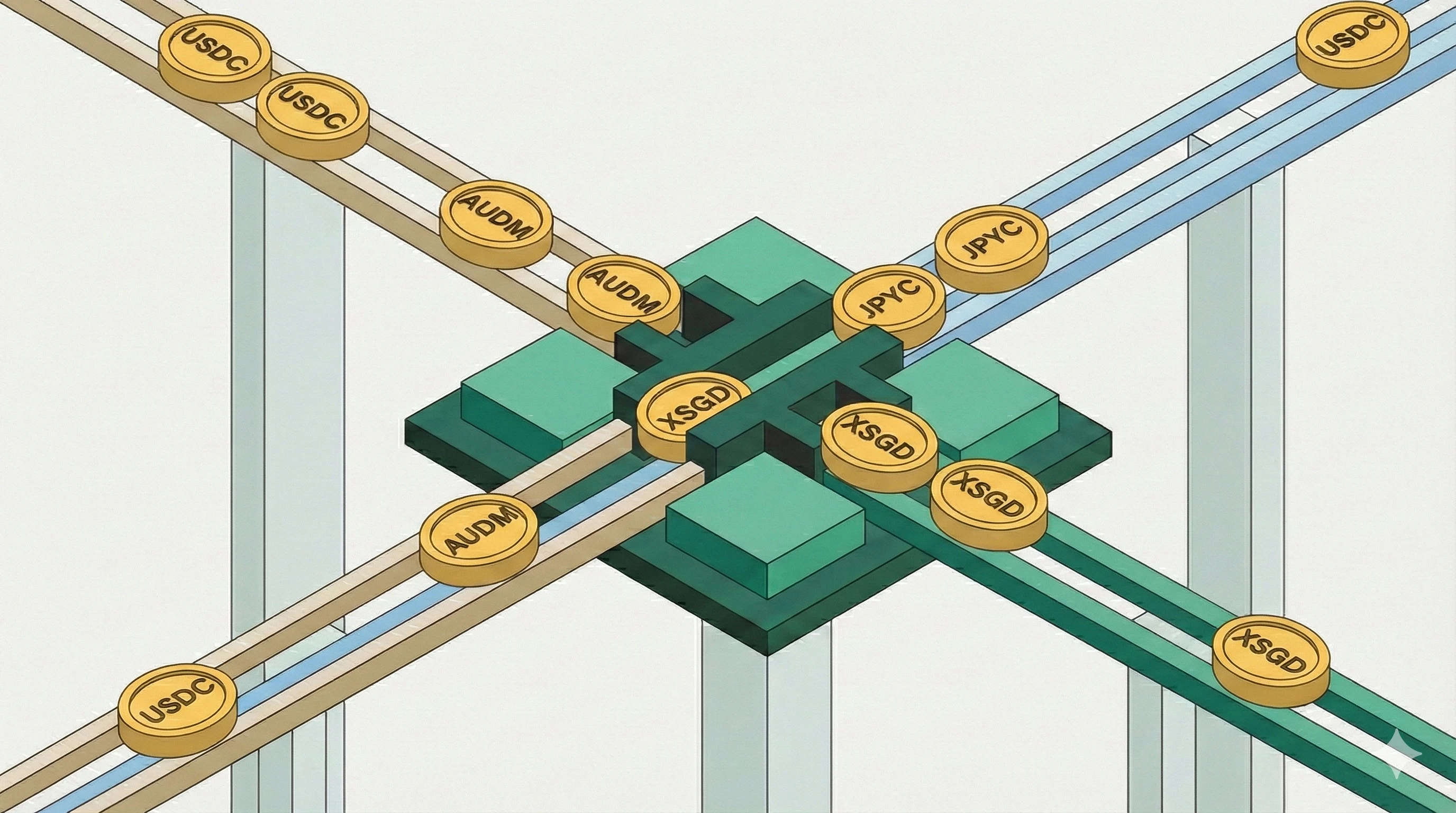

This positions stablecoins as infrastructure connectors, not replacements.

5. Regulation Is the Real Adoption Gate

Across all regions, regulatory clarity and security outrank innovation as adoption drivers.

Enterprises and financial institutions prioritize:

- Regulatory compliance

- Platform stability

- Settlement reliability

Speed alone is insufficient. Stablecoins only scale when embedded into licensed, controlled, and auditable financial environments.

This explains why adoption is accelerating in jurisdictions with clearer regulatory frameworks and slowing where compliance pathways remain uncertain.

6. From Asset to Infrastructure

The data points to a clear conclusion:

Stablecoins are evolving from digital assets into financial infrastructure components.

Their long-term value lies not in holding or yield generation, but in:

- Powering settlement layers

- Enabling programmable money flows

- Supporting 24/7 global commerce

As regulatory frameworks mature and execution layers improve, the institutions that integrate stablecoins into their core payment and treasury architecture will gain structural advantages in speed, capital efficiency, and global reach.

Conclusion

Stablecoins are no longer a future bet. They are a present-day tool for solving real operational problems in global finance.

The next competitive edge will not come from whether an institution adopts stablecoins—but how deeply and how cleanly they are integrated into existing financial systems.

The future of global money movement will be:

- Stable

- Programmable

- Always on